Debunking 6 Myths About Repo Agents

Jul 22, 2024

As an Amazon Associate, Modded gets commissions for purchases made through links in this post.

Starting a career in vehicle repossession can be fulfilling. However, the most persistent repo agent myths can obscure your view of this line of work.

Here are a few misconceptions about this occupation.

1. Repo Agents Stop at Nothing

Repossession is a legal procedure, so you must follow the law when performing your duties. The steps you must observe vary from state to state. You may or may not do your job without a court order or with a sheriff.

Generally, you can only repossess an item without breaching the peace. It may constitute taking a vehicle out of a closed garage unpermitted, threatening or using physical force, or refusing to stop when a debtor resists repossession.

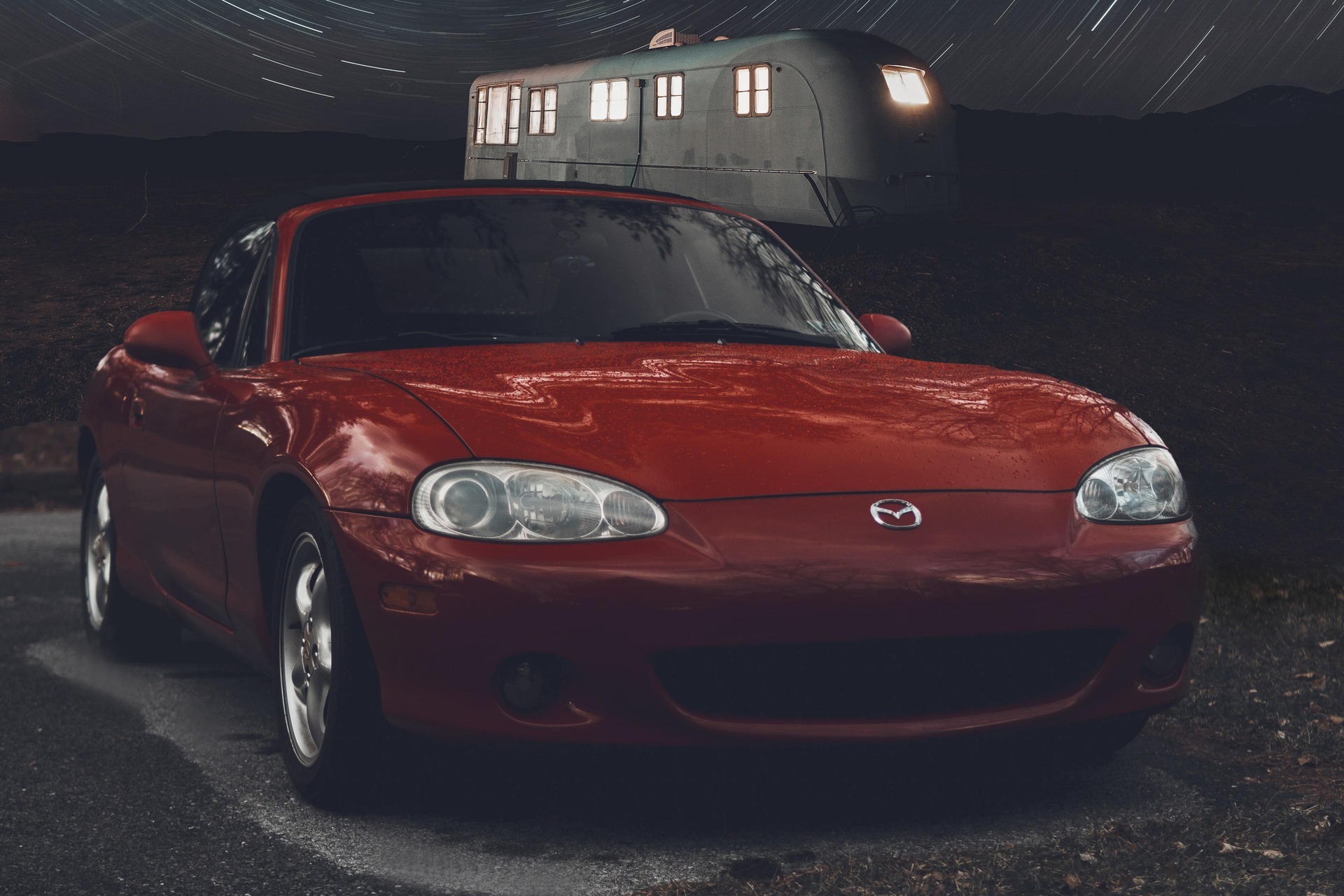

2. Repo Agents Only Handle Cars

Most repo agents seize cars because automobiles are everywhere. However, you may serve clients that finance other assets, so don’t expect to deal exclusively with ordinary sedans, hatchbacks and pickup trucks.

Creditors may contact you to tow trucks, motorcycles, all-terrain vehicles (ATVs) and recreational vehicles. Transporting aircraft, watercraft or any conceivable rented item, like a piece of technology, to a specific location can also be part of the job.

3. Repo Agents Don’t Locate Assets

Skip tracing is within the purview of repo agents. In states that disallow creditors from using kill switches, they rely on these pros to determine asset whereabouts.

Being limited to public records when locating assets is one of the most erroneous repo agent myths. If your target isn’t in the owner’s registered address, you can leverage all available technologies, including GPS trackers and plate scanners, to pinpoint its exact location.

4. Repo Agents Don’t Communicate With Owners

If you become a repo agent, asset recovery will only be one of your responsibilities. You may need to reach out to debtors through various mediums for collection purposes on behalf of your clients. You may have the authority to negotiate payments to collect past-due amounts.

5. Repo Agents Profit From Asset Sales

Like real estate agents, repo agents can earn commissions. However, the commission rate doesn’t depend on how much the loan securities sell for at auctions.

If you work as an independent contractor, you may receive compensation ranging from $150 to $400 per repossessed vehicle — plus bonuses when you do exceptional work. Some companies may have you on staff and pay you an annual salary of up to $70,000.

6. Repo Agents Are Evil

Repo agents exist to enforce legally binding agreements, not cause undue harm. Secured loans are much riskier without feasible enforcement mechanisms. In other words, repo agents help keep auto financing interest rates low.

Repo Agent Myths Dispelled

Seizing something valuable to a person or company can be a stressful gig. Still, somebody has to do it to encourage borrowers to behave accordingly and uphold the sanctity of contracts. You’ll find this career worthwhile if you love motoring and respecting the law.